cumulative preferred stockholders have the right to receive

For holders of cumulative preferred stock the dividends owed continue to accumulate until they are paid. The holders of these preferred shares must receive the 9 per share dividend each year before the common stockholders can receive a penny in dividends.

Accounting Test 1 Chapter 14 Part 3 Flashcards Quizlet

Who are the experts.

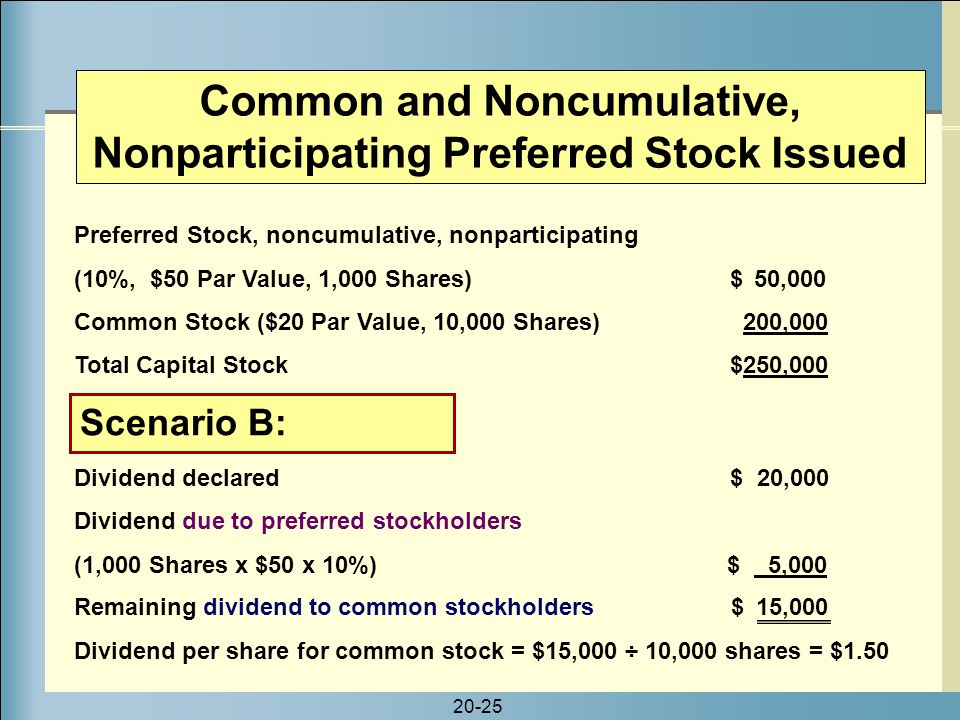

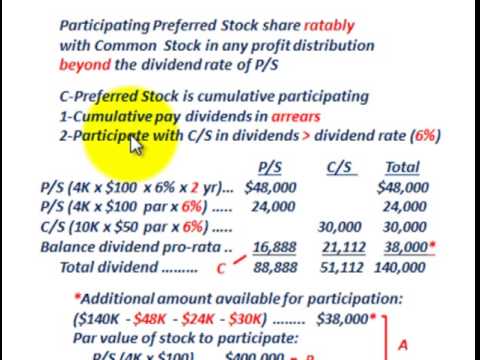

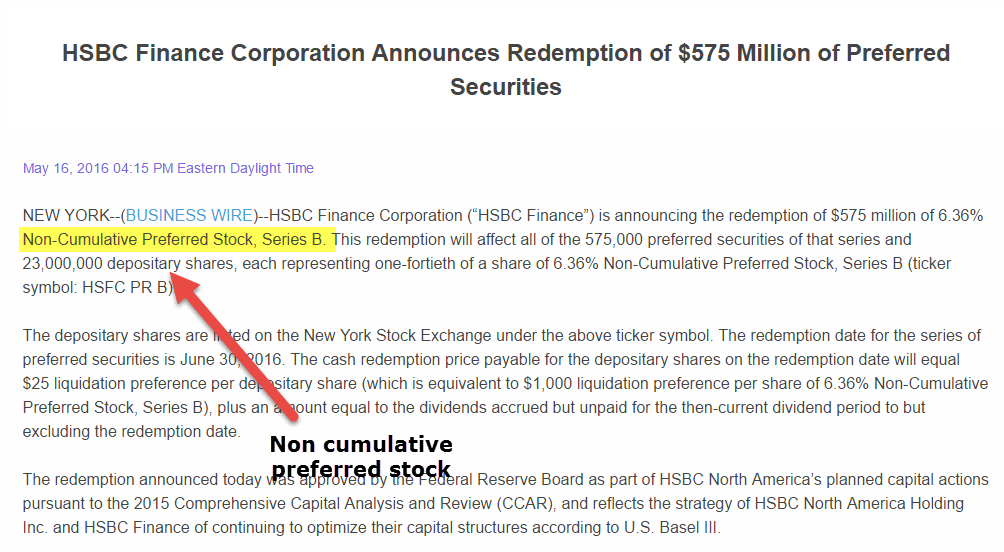

. This term sheet outlines the companys terms of investment. This means that if the company does not declare dividends this year they do not have to pay preferred shareholders the guaranteed dividend amount. A participating feature gives preferred shareholders the right to receive a share of dividends paid to common shareholders.

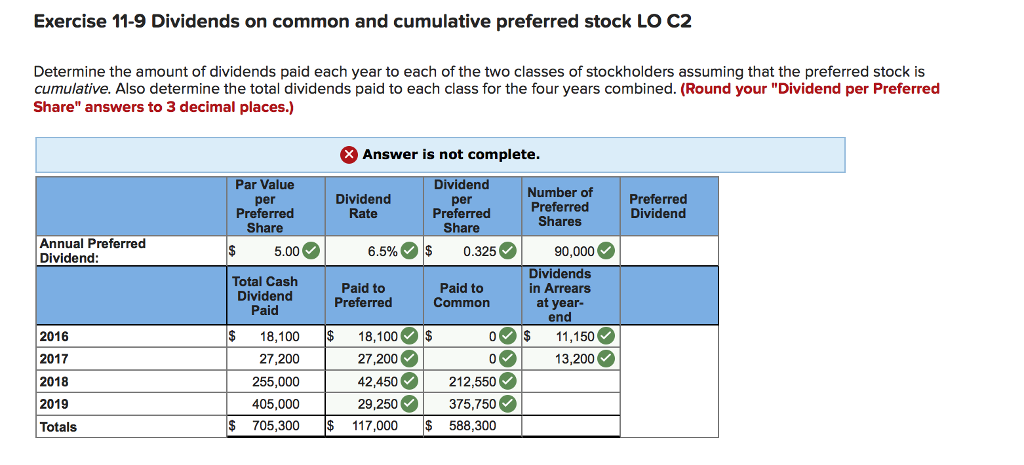

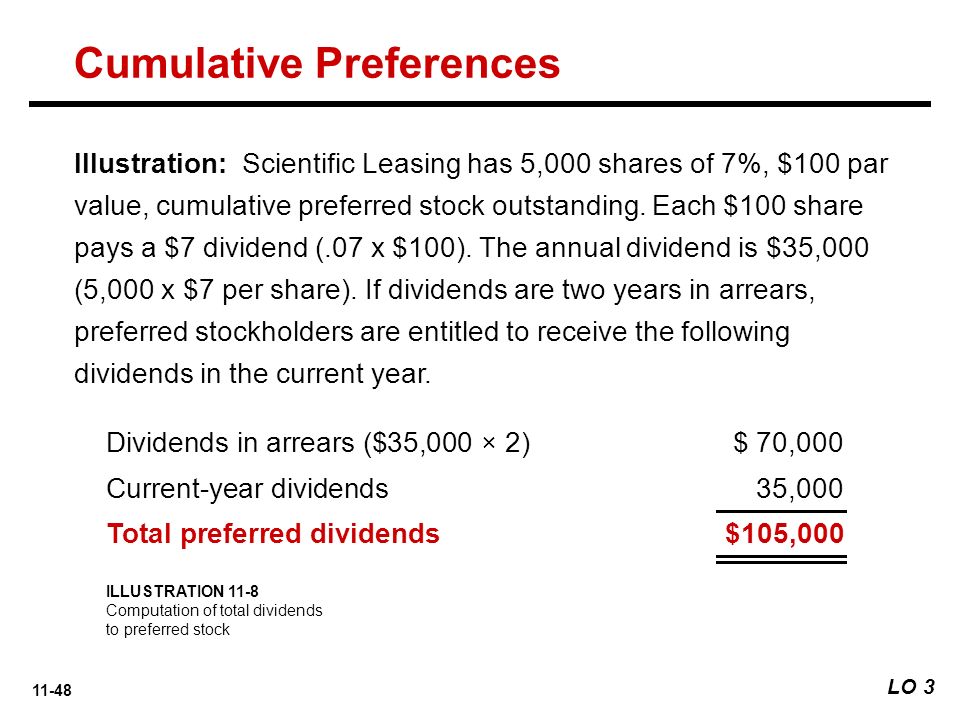

If dividends are not declared in the current year the cumulative shares record the unpaid dividends in an account called dividends in arrears. It is a reliable source and is valued among investors. If a company is unable to distribute dividends to shareholders in the period owed the dividends owed are carried forward until they are paid.

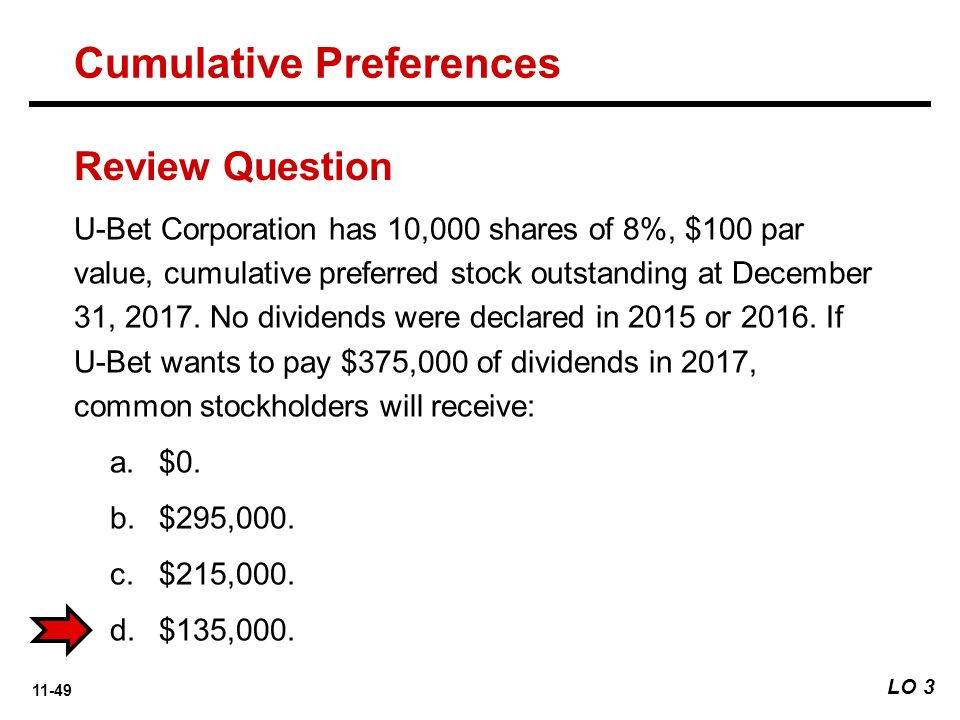

A cumulative dividend is a required fixed distribution of earnings made to shareholders. The shareholders will receive the promised fixed amount whenever the dividends are declared. All dividends in arrears must be paid before any dividends are granted to common shareholders.

Cshould be recorded as a current liability until they are paid. Par value is an arbitrary meaningless value assigned to. Dividends in arrears on cumulative preferred shares anever have to be paid even if common dividends are paid.

All the past omitted dividends are accumulated and assured to be paid. If board of directors decides to pay a dividend of 1200000 in 2021 the cumulative preferred stockholders will be paid a total dividend of 1000000 5 per share for two years. It means that cumulative preferred shares are important that the noncumulative.

Rather if dividends are declared the preferred stockholders have the right to receive their preferred dividend before the common stockholders are paid any dividends. The calculation of accumulated unpaid dividends depends on the term sheet. Cumulative dividend payments are made on a first-incurred first-paid basis.

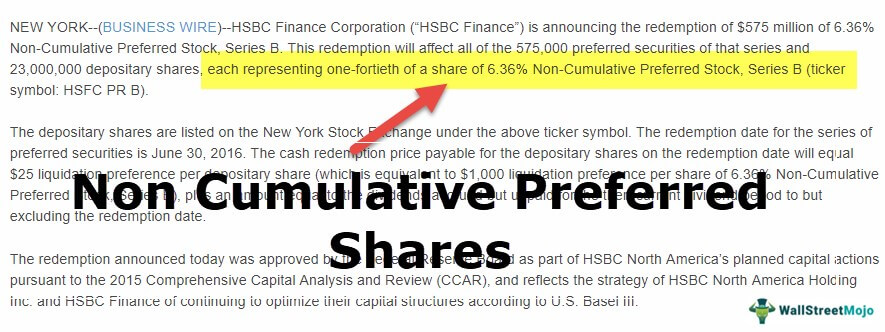

However in the case of cumulative preferred shareholders the company has an obligation of ensuring that such shareholders receive all their pending dividends. By contrast if a company issues noncumulative preferred stock its preferred shareholders have no future right to receive dividends that the company chooses not to pay. With cumulative preferred stock the company must keep track of the dividends it chooses not to pay to its preferred shareholders.

Companies must pay unpaid cumulative preferred dividends before paying any dividends on. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. One of these rights may be the right to cumulative dividends.

See also Bullish and Bearish Market Meaning Relevance and more How do Cumulative Preferred Stocks work. Cumulative preferred shares have the right to be paid current and past years unpaid dividends before common stock shareholders are paid. The same shareholders have a right to claim any pending dividend payment the issuing company owes them.

Priority preferred Preemptive preferred Dividends are not paid 10. Cumulative preferred stocks right to receive dividends is forfeited in any year that dividends are not declared while noncumulative stocks undeclared dividends accumulate each year until. Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed.

Holders of cumulative preferred shares are entitled to receive dividends retroactively for any dividends that were not paid in prior periods whereas non-cumulative preferred shares do not carry. We review their content and use your feedback to keep the quality high. Has a right to receive regular dividends that were not declared paid in prior years.

Cumulative Preferred Stockholders are entitled to their preferential right to receive dividends. Companies often issue cumulative preferred shares as a source of long-term financing that helps the companies to raise considerable finance. Preferred stockholders have the right to receive dividends before common stockholders.

But the preferred shareholders will get no more than the 9 dividend even. Bmust be paid before common shareholders can receive a dividend. All dividends owed to holders of cumulative preferred shares must be paid before holders of.

500000 for 2020 500000 for 2021. Cumulative preferred stocks are entitled to receive all the missed unpaid dividends. Preferred shares are the most common type of share class that provides the right to receive cumulative dividends.

Cumulative Preferred Stock stockholders have the right to receive dividends in arrears their regular dividends passed or not paid in previous years before common shareholders may receive a dividend. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. On the other hand preferred stock normally carries no voting rights.

You may retain the right to suspend payment of dividends. The remaining amount of 200000 can then be distributed among common stockholders. Non cumulative preferred stock does not have this right arrears cumulative preferred stock dividends that have not been paid in prior years.

Cumulative shareholders will receive both current year and unpaid past dividends before anything is paid out to common shareholders. This type of preferred stockis oled Cumulative preferred. If preferred stock is designated as cumulative the suspended dividends accumulate and you must later pay them in full.

Preferred stock shareholders already have rights to dividends before common stock shareholders but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate then the issuer will have to make up for it as time goes on. Denable the preferred shareholders to share equally in corporate profits with the common shareholders. Experts are tested by Chegg as specialists in their subject area.

Common And Preferred Stock Principlesofaccounting Com

11 Reporting And Analyzing Stockholders Equity Ppt Download

Solved York S Outstanding Stock Consists Of 90 000 Shares Of Chegg Com

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Corporations Formation And Capital Stock Transactions Ppt Download

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

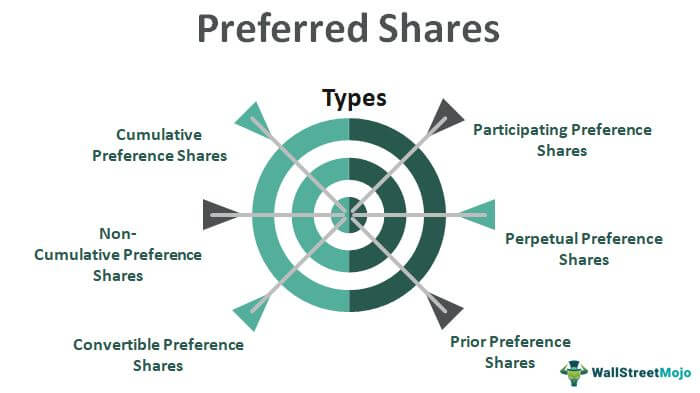

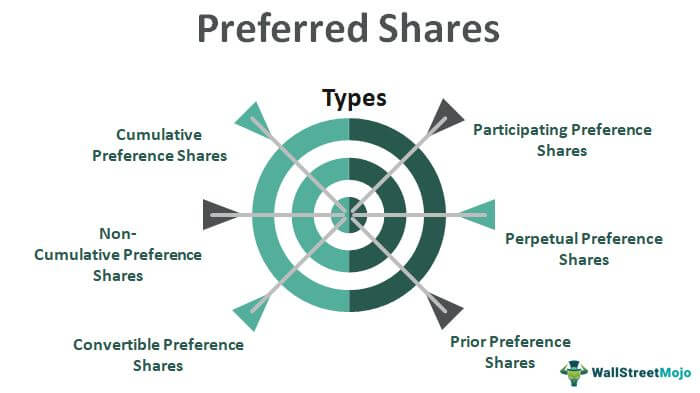

Preferred Shares Meaning Examples Top 6 Types

Non Cumulative Preference Shares Stock Top Examples Advantages

Cumulative Preferred Stock Definition Business Example Advantages

11 Reporting And Analyzing Stockholders Equity Ppt Download

Intermediate Accounting 17e Ppt Download

Accounting For Corporations Ppt Download

Accounting Ch 13 Flashcards Quizlet

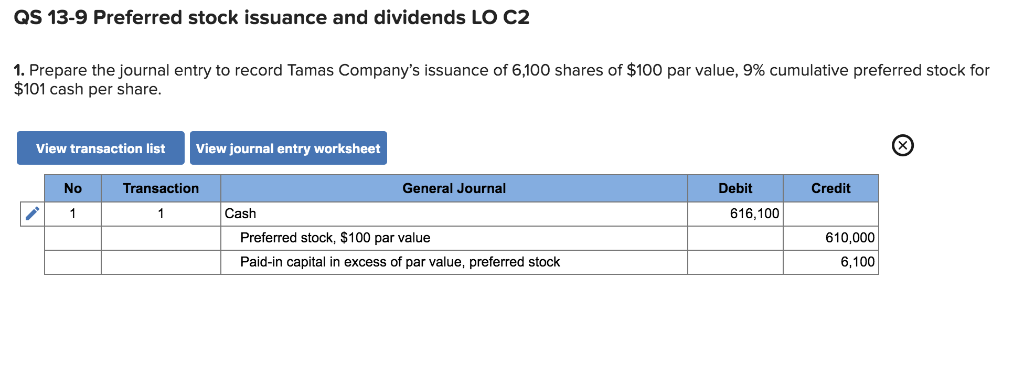

Solved Qs 13 9 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

Preferred Shares Meaning Examples Top 6 Types

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Shares Meaning Examples Top 6 Types

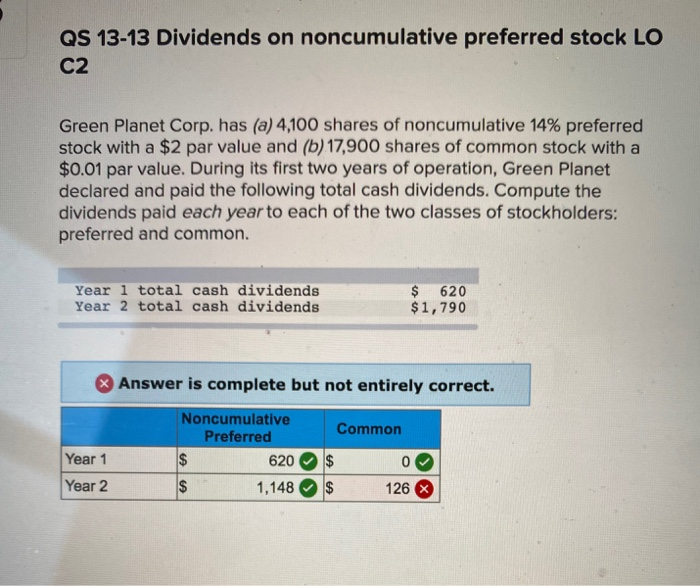

Solved Qs 13 13 Dividends On Noncumulative Preferred Stock Chegg Com

Difference Between Cumulative And Non Cumulative Preferred Stocks With Table Ask Any Difference